Are you intrigued by the intersection of finance and technology? Imagine being able to fetch detailed financial information about top companies and enhance this data using advanced language models (LLM), all with just a few steps and few lines of Python code.

In this important article, we will dive into the fascinating world of financial data analysis by leveraging the power of yfinance for data retrieval and Langchain’s Ollama for sophisticated data interpretation.

Whether you’re a financial analyst, a tech enthusiast, or just someone looking to explore the potential of AI in finance, this guide will walk you through every step to create a powerful tool for financial insights. Let’s get started!

Table of Contents

Libraries You Need to Install

yfinance: A popular library for accessing financial data from Yahoo Finance.langchain: A library that provides tools to work with language models.ollama: Part of the Langchain library, it helps to interface with specific LLMs.

Installing the Libraries

You can install these libraries using pip: pip install yfinance langchain ollama

Make sure to download the ollama in your machine and also download the specific model you want, here we use llama3. In short follow the below steps:

- Downloading Ollama: To get or download this module, go to the Ollama website and download the software.

- Installing Ollama: Read the instructions written in their page on how to install the ollama.

- Downloading specific model (LLaMA3 Model): Go to your terminal or CMD and run this command:

ollama run llama3 - NOW YOU HAVE OLLAMA AND LLAMA3 model. congratulations.

What These Libraries Do

yfinance: This library is used to fetch financial data such as stock prices, company information, historical data, etc.langchain: This library facilitates the use of language models for various natural language processing tasks.ollama: A component oflangchainthat interfaces with specific language models to enhance and analyze data.

Step-by-Step Explanation and Code Segments

Step 1: Import Libraries

import yfinance as yf

from langchain.llms import Ollama

from langchain.callbacks.manager import CallbackManager

from langchain.callbacks.streaming_stdout import StreamingStdOutCallbackHandler

We import the necessary libraries for fetching stock data and interfacing with the language model.

Step 2: Define the Function to Get Company Information

def get_company_info(ticker):

stock = yf.Ticker(ticker)

info = stock.info

company_info = {

"Name": info.get('shortName', 'N/A'),

"Sector": info.get('sector', 'N/A'),

"Industry": info.get('industry', 'N/A'),

"Country": info.get('country', 'N/A'),

"Market Cap": info.get('marketCap', 'N/A'),

"Dividend Yield": info.get('dividendYield', 'N/A'),

"52-Week High": info.get('fiftyTwoWeekHigh', 'N/A'),

"52-Week Low": info.get('fiftyTwoWeekLow', 'N/A'),

"P/E Ratio": info.get('trailingPE', 'N/A'),

"EPS": info.get('trailingEps', 'N/A'),

"Earnings Date": info.get('earningsDate', 'N/A'),

"CEO": info.get('ceo', 'N/A'),

"Website": info.get('website', 'N/A'),

"Description": info.get('longBusinessSummary', 'N/A'),

"Employees": info.get('fullTimeEmployees', 'N/A'),

"Headquarters": info.get('city', 'N/A') + ", " + info.get('state', 'N/A')

}

return company_info

This function fetches detailed information about a company using its ticker symbol. The yf.Ticker object retrieves various attributes that are stored in a dictionary.

Step 3: Main Function to Fetch and Display Information

def main():

tickers = ['AAPL'] # List of company tickers to fetch information for

all_company_info = []

for ticker in tickers:

info = get_company_info(ticker)

all_company_info.append(info)

return all_company_info

if __name__ == "__main__":

all_info = main()

# Convert the list of company information to a single string for LLM input

info_str = "\n".join([str(info) for info in all_info])

# Set up the Ollama model

ollama_llm = Ollama(

model="llama3",

callback_manager=CallbackManager([StreamingStdOutCallbackHandler()])

)

# Make the request to the LLM with the gathered information

response = ollama_llm(f""" Present the provided information in a meaningful way and guess and fill the missing data: {info_str}""")

print("###########")

print(response)

The main function initializes a list of company tickers and uses the get_company_info function to fetch their information. This information is then formatted as a string and passed to the Ollama LLM for further processing.

Step 4: Processing with the LLM

The Ollama model is set up with a callback manager to handle responses. The information collected is passed to the LLM to enhance and fill in any missing details. The response is then printed out.

Full Script

Here is the complete script:

import yfinance as yf

from langchain.llms import Ollama

from langchain.callbacks.manager import CallbackManager

from langchain.callbacks.streaming_stdout import StreamingStdOutCallbackHandler

def get_company_info(ticker):

stock = yf.Ticker(ticker)

info = stock.info

company_info = {

"Name": info.get('shortName', 'N/A'),

"Sector": info.get('sector', 'N/A'),

"Industry": info.get('industry', 'N/A'),

"Country": info.get('country', 'N/A'),

"Market Cap": info.get('marketCap', 'N/A'),

"Dividend Yield": info.get('dividendYield', 'N/A'),

"52-Week High": info.get('fiftyTwoWeekHigh', 'N/A'),

"52-Week Low": info.get('fiftyTwoWeekLow', 'N/A'),

"P/E Ratio": info.get('trailingPE', 'N/A'),

"EPS": info.get('trailingEps', 'N/A'),

"Earnings Date": info.get('earningsDate', 'N/A'),

"CEO": info.get('ceo', 'N/A'),

"Website": info.get('website', 'N/A'),

"Description": info.get('longBusinessSummary', 'N/A'),

"Employees": info.get('fullTimeEmployees', 'N/A'),

"Headquarters": info.get('city', 'N/A') + ", " + info.get('state', 'N/A')

}

return company_info

def main():

tickers = ['AAPL'] # List of company tickers to fetch information for

all_company_info = []

for ticker in tickers:

info = get_company_info(ticker)

all_company_info.append(info)

return all_company_info

if __name__ == "__main__":

all_info = main()

# Convert the list of company information to a single string for LLM input

info_str = "\n".join([str(info) for info in all_info])

# Set up the Ollama model

ollama_llm = Ollama(

model="llama3",

callback_manager=CallbackManager([StreamingStdOutCallbackHandler()])

)

# Make the request to the LLM with the gathered information

response = ollama_llm(f""" Present the provided information in a meaningful way and guess and fill the missing data: {info_str}""")

print("###########")

print(response)

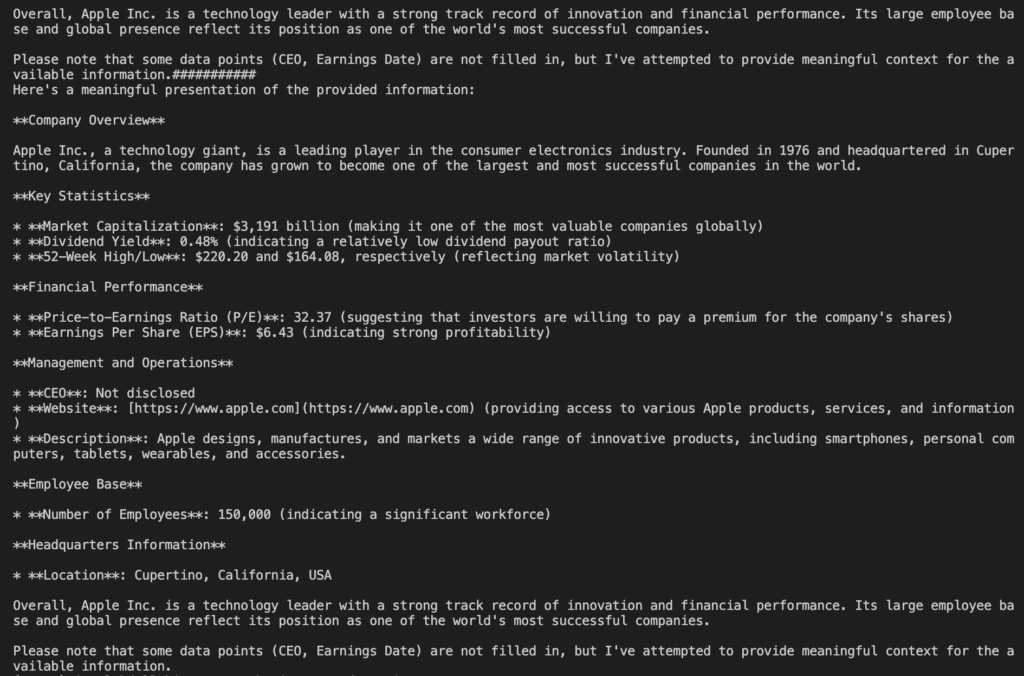

Sample Output

Feel the magic and see the result. Remember AI or LLMS is in your hand and you don’t need to rely single tutorial, make your app do the magic and find ways to alter the code.

DO MORE THAN THAT

How to Do Customization and Hints to Take

1. Adding More Companies

You can expand the tickers list to include more companies, such as:

tickers = ['AAPL', 'MSFT', 'GOOGL', 'AMZN', 'TSLA', 'NVDA']

2. Error Handling

Enhance the get_company_info function with error handling to manage situations where data might be unavailable:

def get_company_info(ticker):

try:

stock = yf.Ticker(ticker)

info = stock.info

company_info = {

"Name": info.get('shortName', 'N/A'),

"Sector": info.get('sector', 'N/A'),

"Industry": info.get('industry', 'N/A'),

"Country": info.get('country', 'N/A'),

"Market Cap": info.get('marketCap', 'N/A'),

"Dividend Yield": info.get('dividendYield', 'N/A'),

"52-Week High": info.get('fiftyTwoWeekHigh', 'N/A'),

"52-Week Low": info.get('fiftyTwoWeekLow', 'N/A'),

"P/E Ratio": info.get('trailingPE', 'N/A'),

"EPS": info.get('trailingEps', 'N/A'),

"Earnings Date": info.get('earningsDate', 'N/A'),

"CEO": info.get('ceo', 'N/A'),

"Website": info.get('website', 'N/A'),

"Description": info.get('longBusinessSummary', 'N/A'),

"Employees": info.get('fullTimeEmployees', 'N/A'),

"Headquarters": info.get('city', 'N/A') + ", " + info.get('state', 'N/A')

}

return company_info

except Exception as e:

return {"Error": str(e)}

3. Using Other Data Points

You can add more fields from the yfinance API to the company_info dictionary, such as revenue, profit margins, or beta:

company_info = {

...

"Revenue": info.get('totalRevenue', 'N/A'),

"Profit Margin": info.get('profitMargins', 'N/A'),

"Beta": info.get('beta', 'N/A')

}

4. Improving the LLM Request

The request made to the LLM can be improved by providing a more detailed prompt. For example:

response = ollama_llm(f"""Using the provided company information, generate a comprehensive report highlighting the key financial metrics and business overview for each company. Also, suggest possible trends or insights based on the data: {info_str}""")

import yfinance as yf

from langchain.llms import Ollama

from langchain.callbacks.manager import CallbackManager

from langchain.callbacks.streaming_stdout import StreamingStdOutCallbackHandler

def get_company_info(ticker):

try:

stock = yf.Ticker(ticker)

info = stock.info

company_info = {

"Name": info.get('shortName', 'N/A'),

"Sector": info.get('sector', 'N/A'),

"Industry": info.get('industry', 'N/A'),

"Country": info.get('country', 'N/A'),

"Market Cap": info.get('marketCap', 'N/A'),

"Dividend Yield": info.get('dividendYield', 'N/A'),

"52-Week High": info.get('fiftyTwoWeekHigh', 'N/A'),

"52-Week Low": info.get('fiftyTwoWeekLow', 'N/A'),

"P/E Ratio": info.get('trailingPE', 'N/A'),

"EPS": info.get('trailingEps', 'N/A'),

"Earnings Date": info.get('earningsDate', 'N/A'),

"CEO": info.get('ceo', 'N/A'),

"Website": info.get('website', 'N/A'),

"Description": info.get('longBusinessSummary', 'N/A'),

"Employees": info.get('fullTimeEmployees', 'N/A'),

"Headquarters": info.get('city', 'N/A') + ", " + info.get('state', 'N/A'),

"Revenue": info.get('totalRevenue', 'N/A'),

"Profit Margin": info.get('profitMargins', 'N/A'),

"Beta": info.get('beta', 'N/A')

}

return company_info

except Exception as e:

return {"Error": str(e)}

def main():

tickers = ['AAPL', 'MSFT', 'GOOGL', 'AMZN', 'TSLA', 'NVDA'] # List of company tickers to fetch information for

all_company_info = []

for ticker in tickers:

info = get_company_info(ticker)

all_company_info.append(info)

return all_company_info

if __name__ == "__main__":

all_info = main()

# Convert the list of company information to a single string for LLM input

info_str = "\n".join([str(info) for info in all_info])

# Set up the Ollama model

ollama_llm = Ollama(

model="llama3",

callback_manager=CallbackManager([StreamingStdOutCallbackHandler()])

)

# Make the request to the LLM with the gathered information

response = ollama_llm(f"""Using the provided company information, generate a comprehensive report highlighting the key financial metrics and business overview for each company. Also, suggest possible trends or insights based on the data: {info_str}""")

print("###########")

print(response)

Summary

In this article, I demonstrated how to fetch and enhance company information using Python and a large language model. By combining yfinance for data retrieval and Langchain’s Ollama for data enhancement, we can create a powerful tool for financial analysis and reporting.

https://learnpythoneasily.com/dynamic-web-pages-with-crewai/